VA Loans: Veterans receiving disability Gains may qualify for VA loans, which provide benefits like waived funding expenses, competitive curiosity premiums, and zero deposit possibilities. These loans are notably valuable for support members as well as their families.

Nevertheless, to generally be authorized for the disability loan, you should meet up with a lender’s prerequisites for a personal mortgage. Personalized financial loan eligibility mostly depends on your monetary circumstance.

Money. You must show you have some sort of revenue staying deposited into your banking account often.

You could possibly Enroll in an employer-sponsored plan or obtain somebody strategy from a broker or insurance company.

Financial loan form and intent. The type of loan you’re implementing for affects your approval odds: Secured loans (backed by collateral) are usually easier to receive than unsecured loans.

Payday loans are quick-expression loans that aren’t usually encouraged as they come with higher-curiosity costs and charges – upwards of 300% APR.

If a personal bank loan seems like your very best option, make time to match it to other options. Also, you should definitely Possess a repayment prepare ready to help you prevent slipping at the rear of on payments.

Housing guidance. There are many federal programs available to help you pay for housing as being a disabled individual, regardless of whether you’d wish to reside in an apartment or need assistance shopping for and retaining your individual property.

Specialised loans, like household improvement loans for accessibility updates, may have customized conditions for individuals with disabilities.

Present evidence of your respective disability Advantages, which include award letters or lender statements, to guarantee lenders of the profits steadiness.

Another way to faucet into your property fairness is thru a Home Equity Financial commitment (HEI). An HEI enables you to borrow in opposition to your own home fairness without having to make any further regular payments.

Even though these loans are available, payday loans include large curiosity costs and shorter repayment conditions, which often can build financial pressure. Look at these only as a last vacation resort.

Payment extensions. Talk with your Monthly bill companies about a longer payment strategy or extension on your thanks day in case check here you are behind on payments.

The good news is always that loans aren’t counted as revenue for possibly plan—which is handy, due to the fact in the event you gain an excessive amount of, you could potentially shed your Added benefits. In the event you’re on SSI, you should go a means test monthly to establish you have not more than $two,000 in assets ($3,000 for married couples).

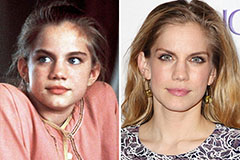

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!